Empowering women farmers and FPOs: Samhita-CGF’s initiative supported by Walmart Foundation

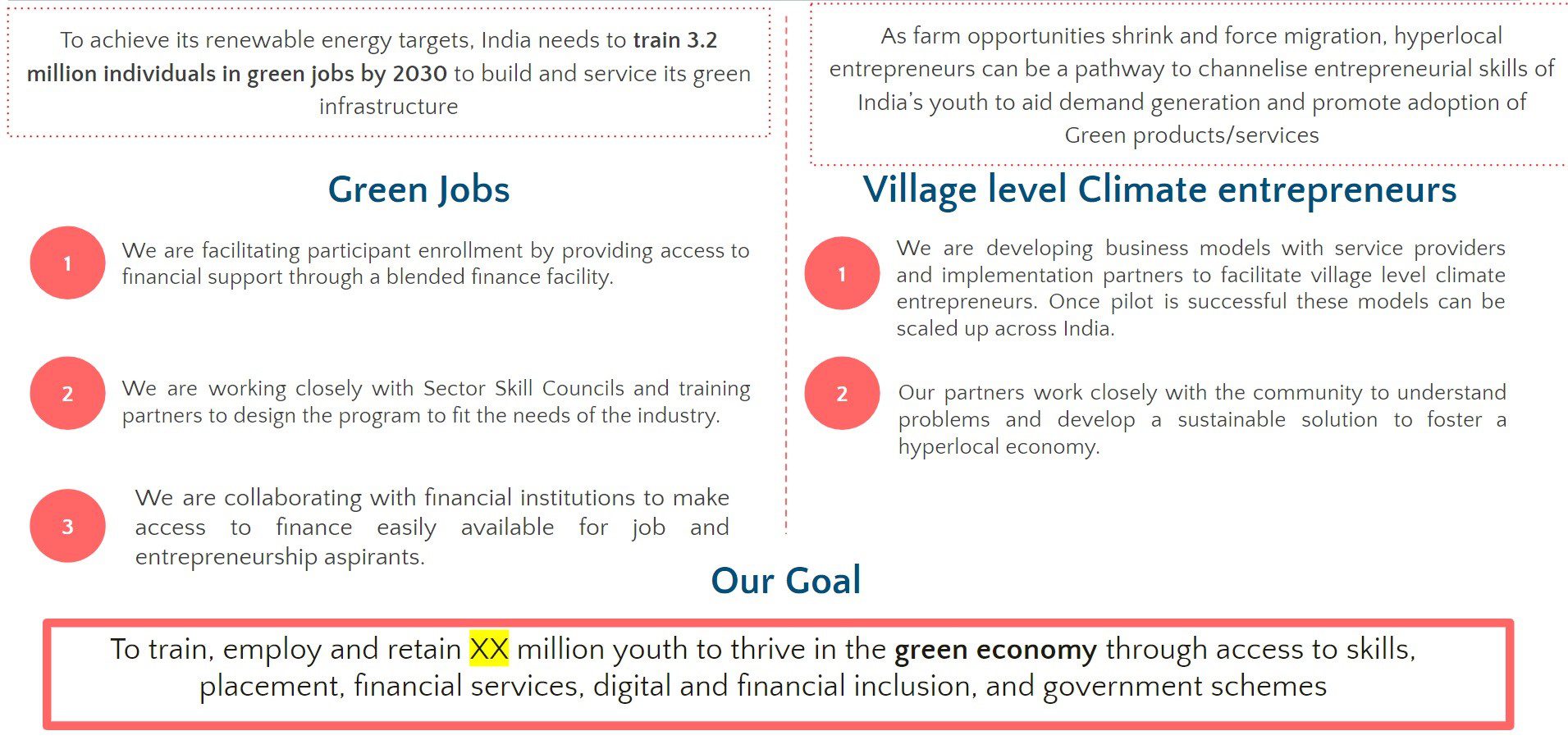

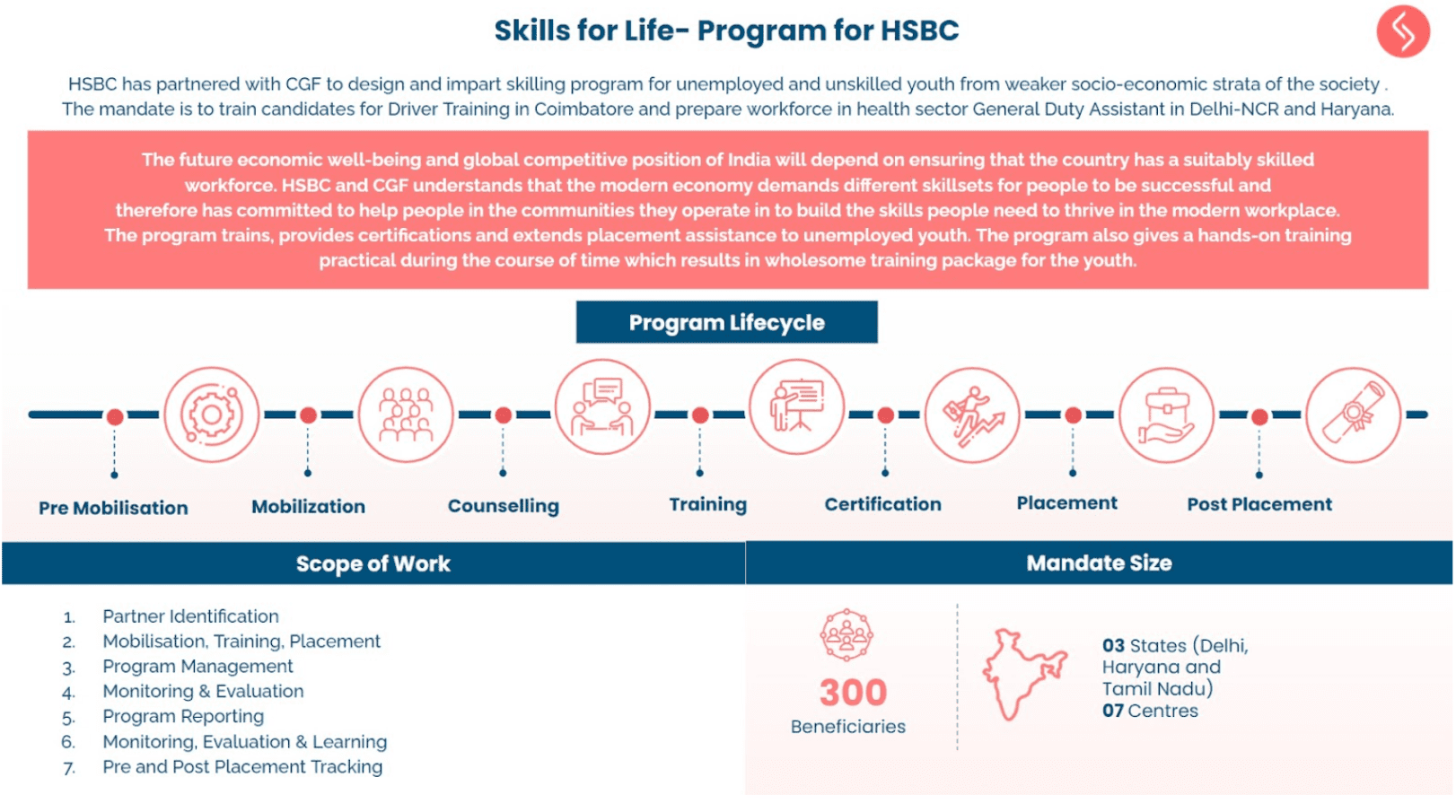

Farmers in Maharashtra face severe challenges, particularly smallholder farmers, who make up 78% of the farming population and own less than two hectares of land (NSS 77th Round). Further, the state is particularly vulnerable to climate change that affects smallholder farmers who have the least capacity to cope (over 36 Mn Ha land was lost due to unseasonal rains in 5 years). Samhita-CGF, supported by the Walmart Foundation, is implementing a comprehensive intervention to address these challenges across 12 Farm Producer Organizations (FPOs), 7 of which are women-led and located in the Marathwada region, while 5 are mixed-gender FPOs based in the Amravati region.

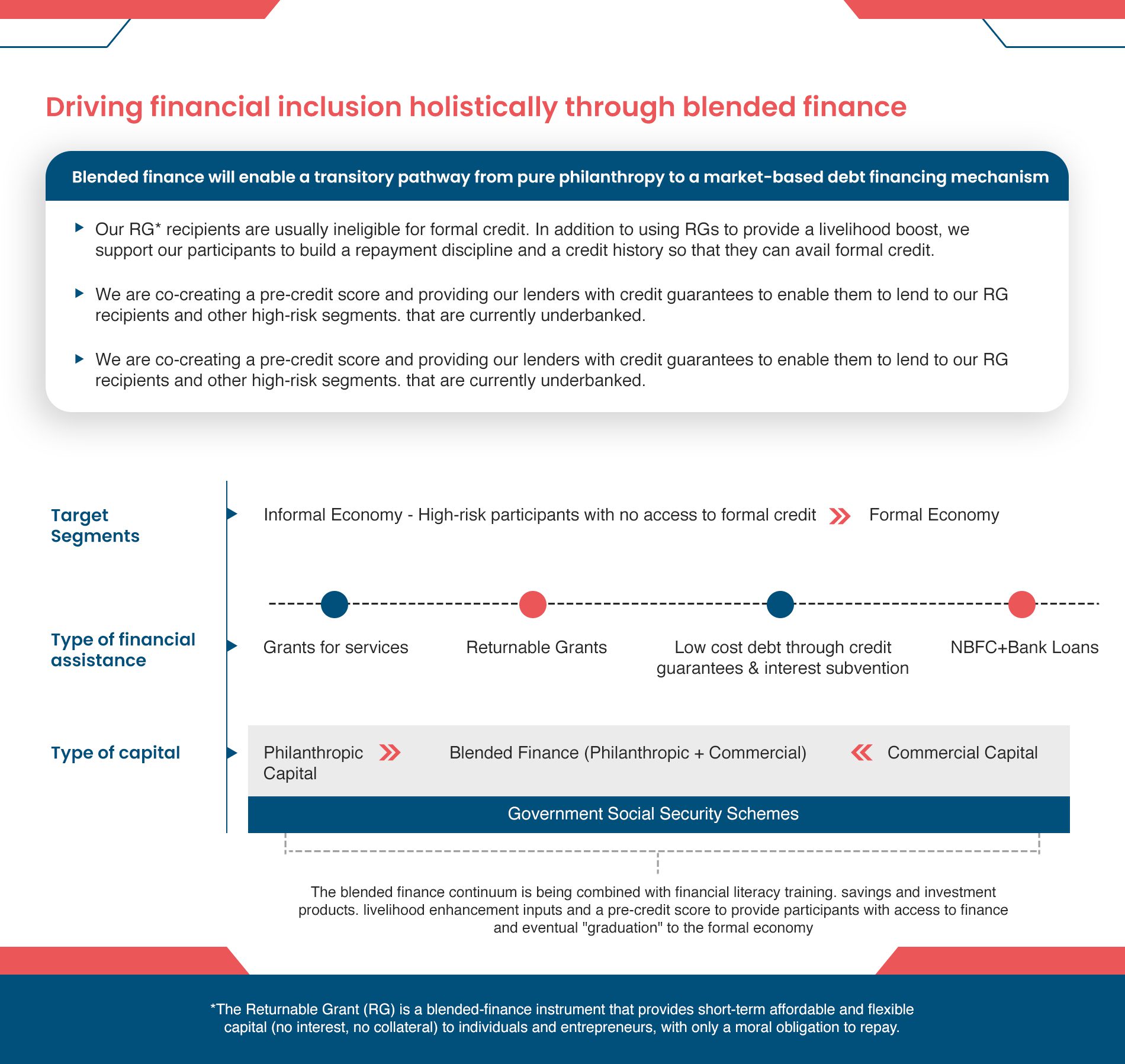

The program’s distinguishing feature is that it strengthens FPO-farmer engagement by addressing the challenges of both these stakeholders in an integrated manner. At the farmer level, support includes blended financing instruments, skills in climate resilient agricultural practices and connections to social security schemes. Farm digitization (using technology to manage land and crop data) also helps farmers adopt data-driven decision-making. At the FPO level, it strengthens organizational capacity through infrastructure, training, IT solutions and market linkages, with a special emphasis on creating sustainable opportunities for women-led FPOs.

As of August 31, 2024, the program has reached 4,694 farmers (2363 are women), including those who have received access to finance (via blended finance instruments) and 2,217 who have undergone training on climate-resilient farming.

Our experience of working with women-only FPOs: Unique challenges and strengths

The journey of the seven women-only FPOs is not without its challenges. While they share common hurdles with mixed-gender FPOs, they also encounter unique obstacles that require focused support.

Navigating unique challenges

One of the foremost challenges women-led FPOs face is the need for capacity building and training. These organizations often emerge from the grassroots efforts of NGOs and Self-Help Groups (SHGs). Encouraging women to join and actively participate in FPOs often takes more time than in mixed-gender groups. Transitioning women from a service mindset to managing a profit-driven business can also be daunting. To address this, CGF offers vital support, equipping women with leadership, governance, and financial management skills to operate independently.

Decision-making in women-led FPOs contrasts with mixed-gender FPOs, where men often dominate leadership. Women-led FPOs promote dialogue and inclusive discussions, creating a more supportive environment for women farmers, addressing challenges like childcare, mobility, and safety.

Market access is another hurdle. Women-led FPOs face mobility restrictions, limited bargaining power, and less exposure to commercial networks, making it harder to compete. Mixed-gender FPOs benefit from established networks which are often led by men, while women-only FPOs need tailored support to connect with large buyers.

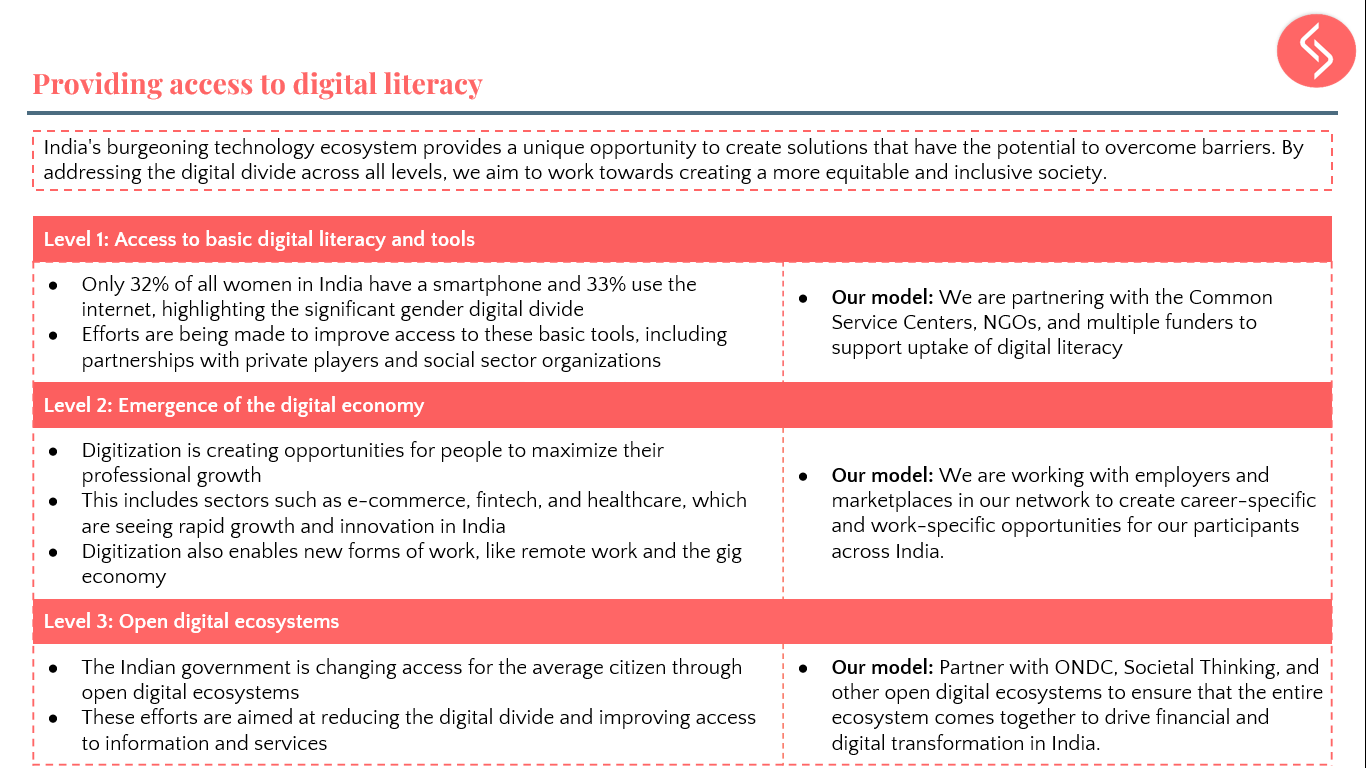

Technology integration is also challenging. Women-led FPOs face the digital gender divide, while mixed-gender FPOs benefit from men’s greater tech exposure.

Financial constraints also play a crucial role in the sustainability of women-led FPOs. Membership fees can pose a barrier for women farmers, as they often lack access to the share capital needed to join an FPO. Land ownership further complicates the landscape, as land rights typically reside with male household members.

Celebrating strengths

Despite these challenges, the strengths of women-only FPOs shine brightly. Once mobilized, women-only FPOs often show stronger social cohesion, driven by confidence and shared commitment to collective goals. Their collaborative structures ensures that the FPO’s business interests and the agri/allied activities of its members are easier to align, creating stronger foundations for income growth.

Women-led FPOs focus on long-term social impact over short-term profits. Their dedication to sustainable agricultural practices and strengthening village groups reflects a commitment to improving the socio-economic landscape of their communities.

Empowerment and agency: The journey of women farmers in Maharashtra

When these women first expressed interest in joining the FPOs, their families were often hesitant, if not outright discouraging. Husbands and in-laws often saw time spent in FPO meetings as lost wages and were wary of women attending without male escorts. In some cases, male family members felt the need to accompany them to meetings.

However, as FPO involvement began yielding tangible results—connecting them with government schemes, credit sources, and valuable training—their social and financial status improved. One woman from the Manjiri Sakhi FPO recalled how her family initially restricted her participation but eventually supported her ventures. She said, “Now, my husband asks me if I have an FPO meeting today and even offers to drop me off. They’ve even started sharing household duties to support my ventures.”

The gradual change in their stories reflects the broader empowerment women have experienced through FPO engagement, linking them to resources like subsidies and crop insurance, and formalizing their roles as entrepreneurs.

Challenges along the path to empowerment

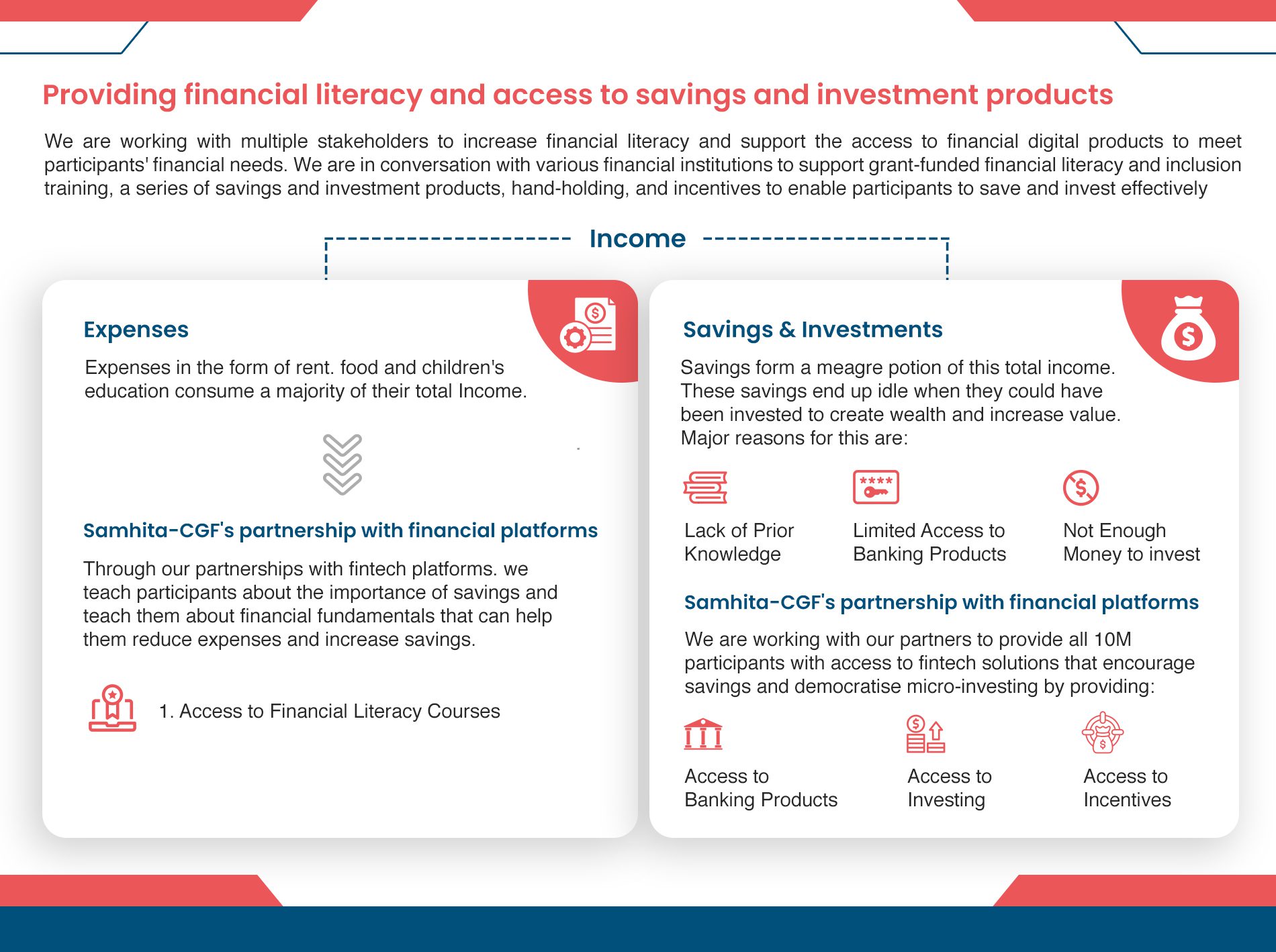

Despite these successes, the women of these FPOs still face significant challenges. A considerable knowledge gap exists in areas such as financial literacy, technology, and market strategy, which limits their ability to fully capitalize on available opportunities. Many women struggle with understanding modern business practices, particularly digital transactions, which hinders the progress of their FPOs.

Social norms also remain a barrier. Women farmers still face scepticism about their ability to manage organizations in the traditionally male-dominated field of agriculture. One member of the Vijaylaxmi Sakhi FPO shared, “When we started, people doubted us. They would say, ‘They’re women… how good can they ever be?’”

Additionally, financial constraints limit their ability to invest in technology, expand production, and reach new markets. Women still face difficulties in accessing larger markets, often relying on middlemen who take a significant share of their profits. As one woman from the Manjiri Sakhi FPO explained, “We grow good-quality produce, but reaching the market is difficult. Without proper transport or connections, we depend on middlemen, and it’s hard to get a fair price for our efforts.”

A case study on Transforming Lives: Sangita Mahanvar’s Journey from Marginal Farming to Empowerment

In the serene village of Dudhodi, Sangita Mahanvar’s life was once confined by traditional expectations. As a marginal farmer, she toiled alongside her husband and son, tending to their crops and caring for their eight cows.

Her turning point came when she participated in farmer training sessions organized by a local NGO(Swayam Shikshan Prayog). It was here she discovered the potential of Farmer Producer Organizations (FPOs) and joined Sarayi Sakhi Producer Company in August 2023. In January 2024, when she learned about the Returnable Grants program of Samhita-CGF funded by the Walmart Foundation, she seized the chance to change her destiny.

With a grant of INR 10,000 and her savings of INR 2,500, Sangita applied for a Khoya-making machine through the PM-FME(Pradhan Mantri Formalisation of Micro Food Processing Enterprises). scheme, which offers a generous 90% subsidy on food processing equipment. With the support of her FPO, she navigated the paperwork and, within a month, proudly purchased the machine valued at INR 1,25,000.

Sangita’s innovation transformed her family’s livelihood. Previously, they sold 50 liters of milk daily at just INR 30 per liter. Now, she crafts 20 kg of Khoya from that milk, selling it for INR 180-200 per kg. This shift has generated an impressive additional monthly income of INR 15,000.

Reflecting on her journey, Sangita shares, “This machine has changed the whole dynamics of my house. I have moved from being an agricultural laborer to running my own business.” Today, she not only takes orders but also purchases milk from her neighbors to meet demand. With her sights set on expansion, Sangita plans to acquire more cows and invest in an additional Khoya-making machine, solidifying her role as a thriving entrepreneur and a role model for aspiring women in her community.

Key lessons from rural women farmers: Shaping our approach to empowerment and growth

Through our extensive work with rural women farmers, several key lessons have emerged, each of which has significantly shaped our approach to empowering these women and strengthening their communities.

Access to resources: Bridging critical gaps

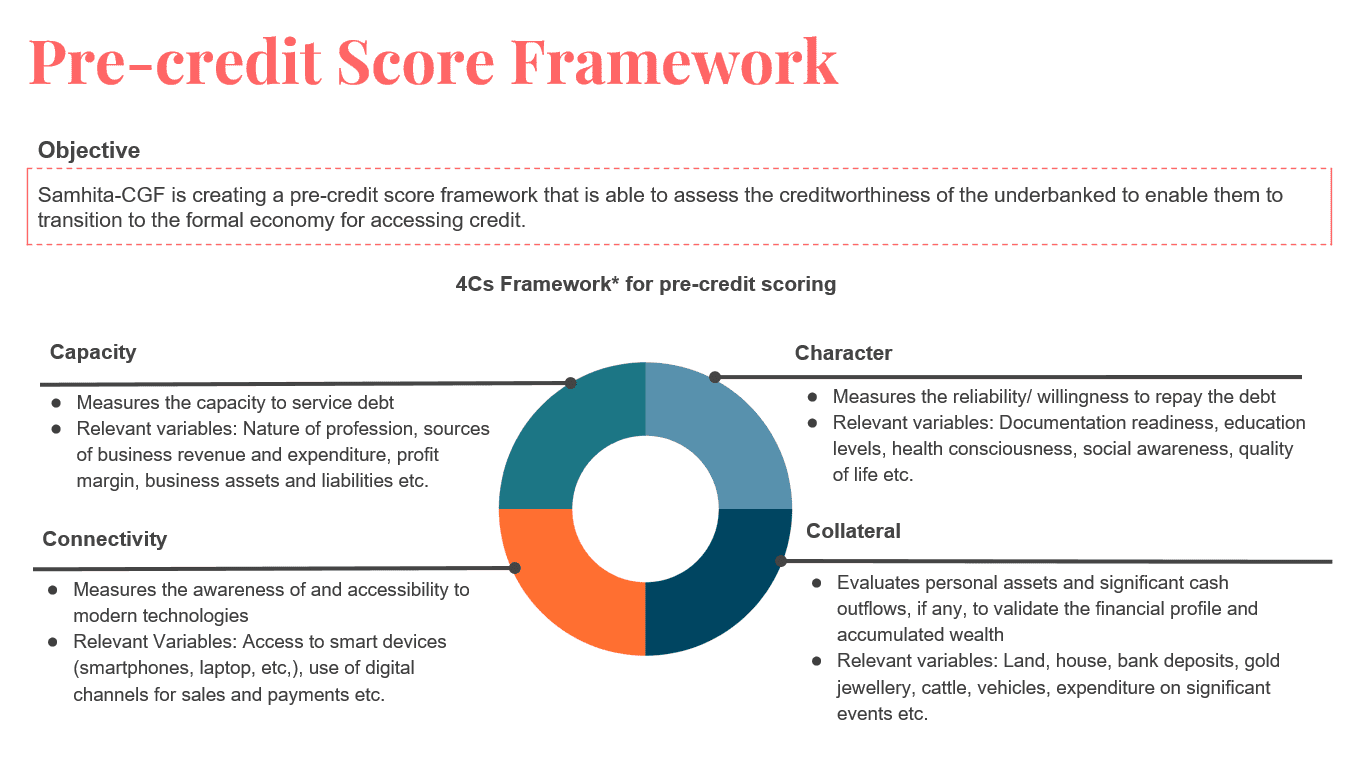

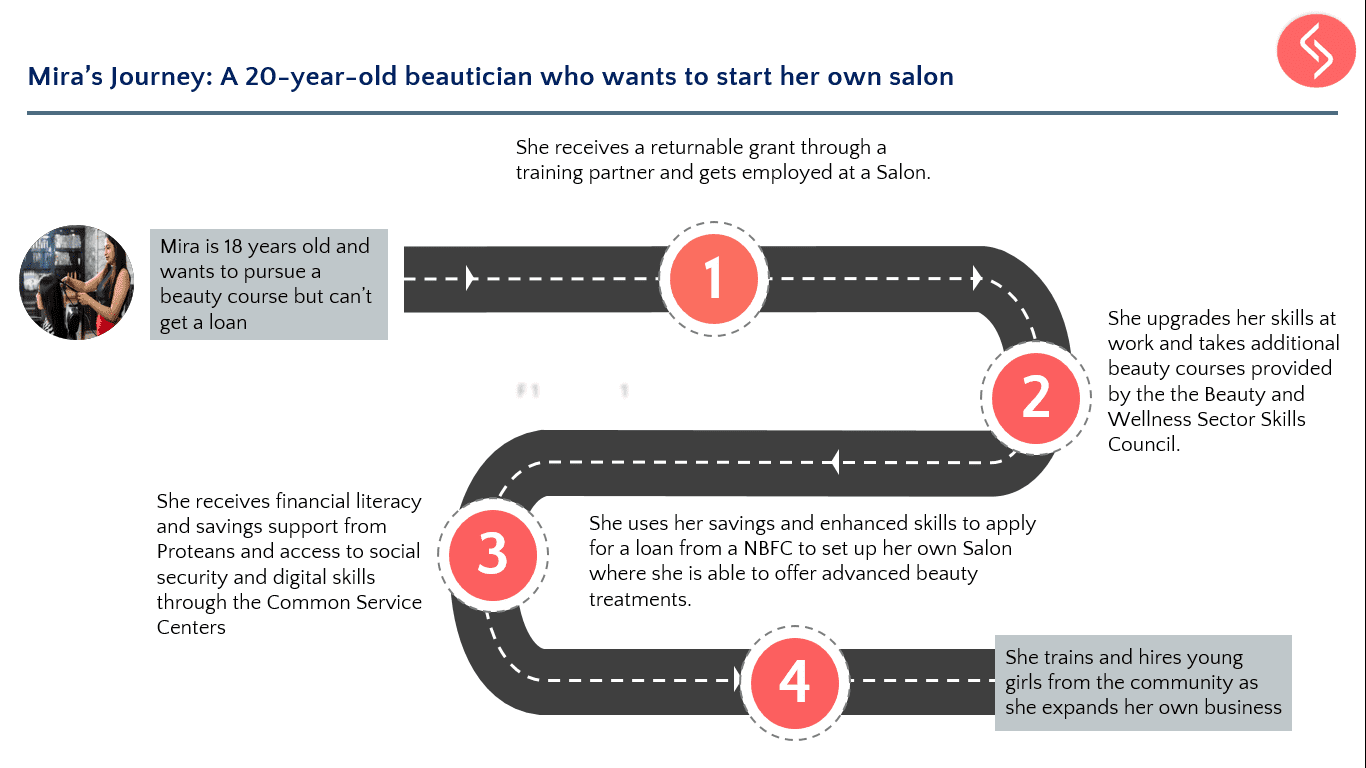

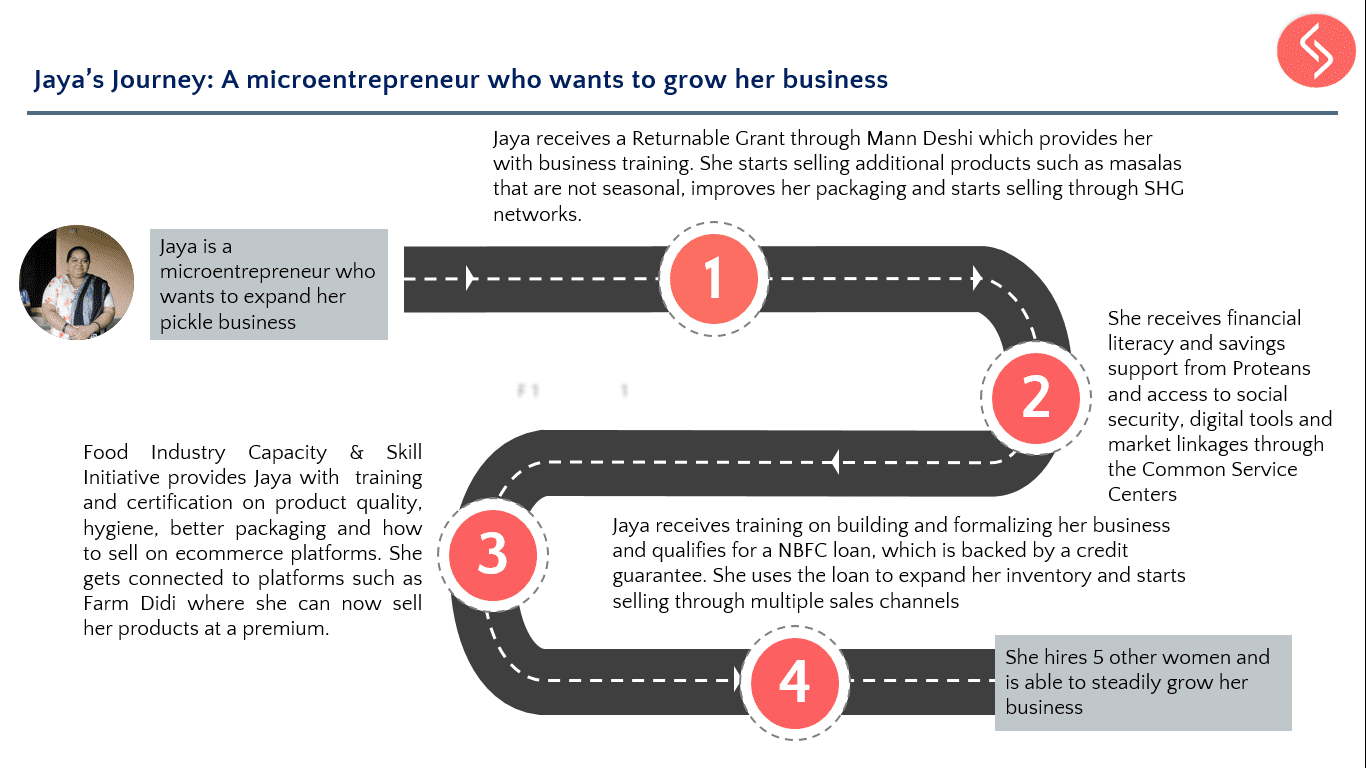

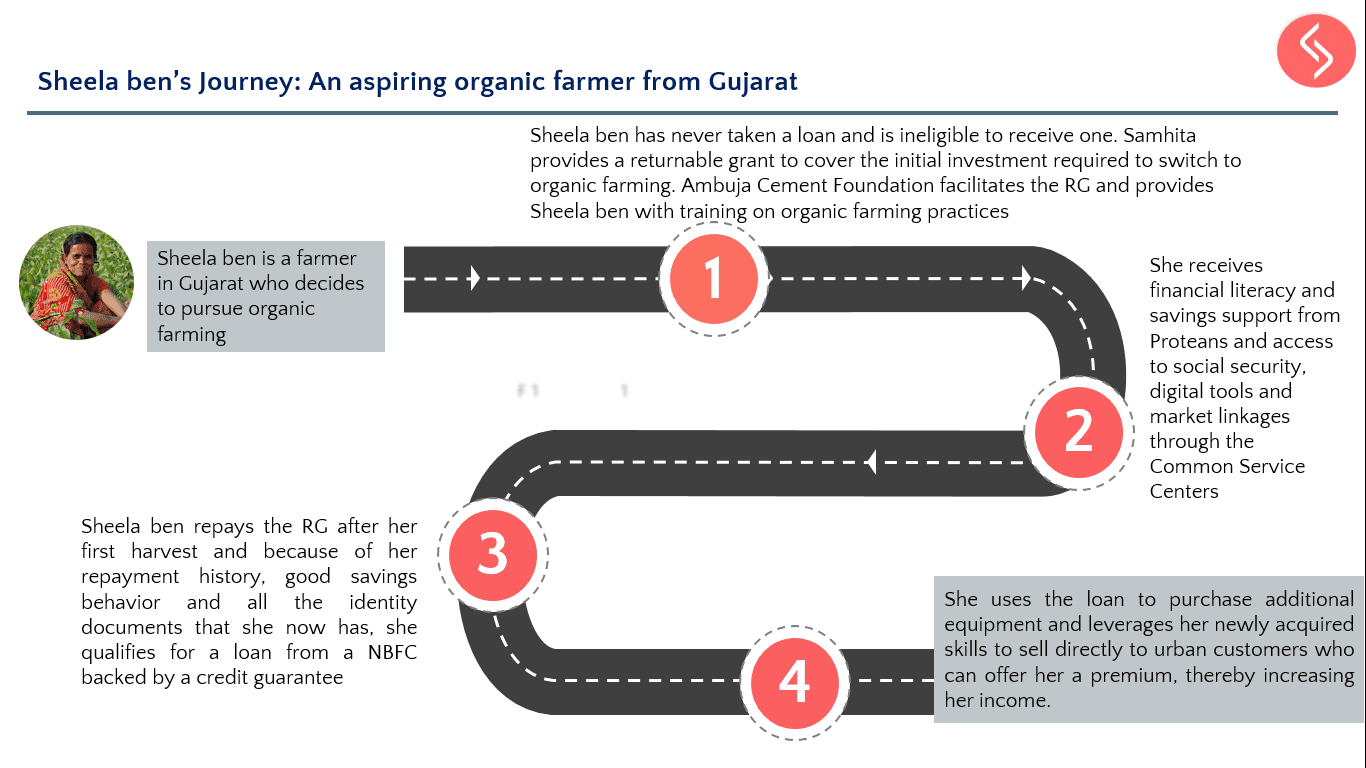

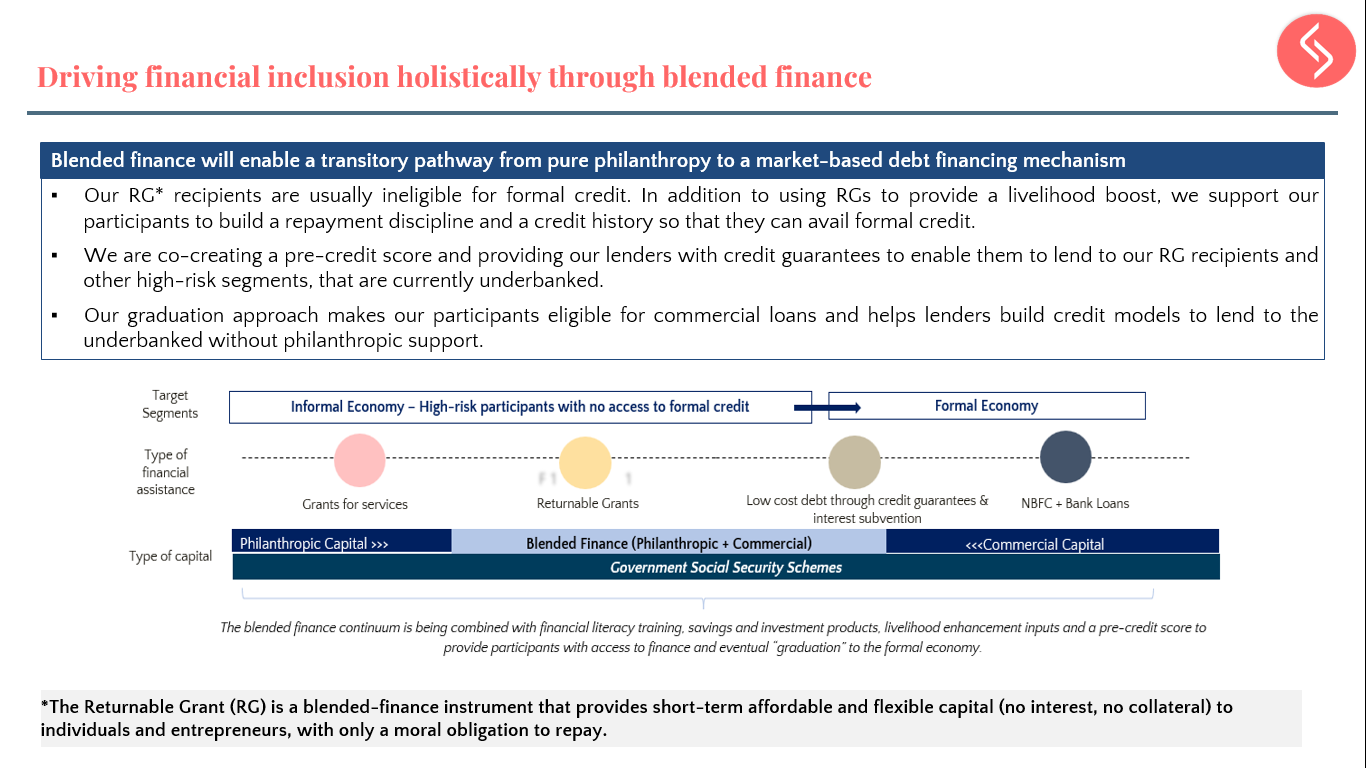

Many women, despite being the primary labor force in agriculture, don’t own the land they cultivate, making access to financial support difficult. We introduced blended finance initiatives such as Returnable Grants (RG) and Credit Guarantees (CG) to provide capital without land ownership.

Balancing multiple roles: Empowering through shared responsibility

Rural women farmers juggle household chores, farm work, and FPO participation. This can overwhelm them and hinder income generation. To address this, we plan gender mainstreaming sessions to educate their male counterparts on shared responsibilities.

Resilience in the face of climate change

Women farmers are not only more vulnerable to the impacts of climate change but also more adaptable. Supported by FPOs, they’ve shown resilience in adopting climate-smart practices. We conduct regular training to equip them with the skills needed to face climate challenges.

Tech access: Empowering decision-making

Technology has transformed decision-making for FPOs. By onboarding our 12 FPOs onto the Doordrishti platform, we’ve provided women farmers with real-time data, enhancing their decision-making and helping them navigate the agricultural market.

Looking forward

These lessons have profoundly informed our approach. Increasing access to credit, co-creating solutions based on traditional knowledge, and building climate resilience are central to ensuring rural women farmers have the tools and support to thrive.